- Tech:NYC Newsletter

- Posts

- Tech:NYC Digest: May 20

Tech:NYC Digest: May 20

Tech:NYC Digest: May 20

Thursday, May 20, 2021Happy Thursday! With New York’s big reopening day behind us, the daily digest is getting a makeover. We’ll still be sending out relevant updates on the pandemic and what it means for your work, your offices, and your lives in the city, but we’re excited to provide a resource that helps you look ahead, too!

As we kick this off, we’d love your feedback — are there topics we’re missing? Things that feel less useful now? Just reply to this email or send us your suggestions here.Was this digest forwarded to you? Subscribe here.

Reopening Day came and went, and NYC didn’t descend into chaos. That’s good news, but the obvious next question is: now what?

First things first: Mayor de Blasio and public health officials are reminding New Yorkers that just because reopening is in full swing does not mean the pandemic is over. As we outlined yesterday, many NYC businesses and residents are taking a more cautious, gradual approach to reopening, and while fully vaccinated people can now mostly move about the city maskless, the prevailing thought is “when in doubt, wear a mask.” (amNY) We think that’s good advice.

Here’s what’s next: With most restrictions lifted, the city and state are turning even more attention to outreach for those still unvaccinated. As of today, four million NYC residents (nearly 54 percent of all adults) have at least one dose, but millions more still need their shots. (Wall Street Journal) To help get rates up, some new incentives were announced today:

Vax & Scratch: Next week, anyone who gets a shot at any of the ten mass vaccination sites also walks away with a free Mega Multiplier lottery ticket. Top prize is $5 million, but ticket holders have a one-in-nine chance of winning cash at other levels starting at $20. (Gothamist)

Take a Flight, Take a Shot: New York is also standing up pop-up vaccination sites at seven airports across the state, including JFK and LaGuardia, for any US resident arriving or departing there. (ABC New York)

The other big priority moving forward will be our economic recovery — in many ways, we’ve only just begun what will inevitably be a long process.

We’re staring down a unemployment rate that's nearly double the national average, but tourism — a major driver of hospitality industry employment — is slowly reemerging after being decimated by months-long shutdowns. In an effort to jumpstart it, Mayor de Blasio announced that the city will pause the hotel occupancy tax for the summer. (NY1)

Little Island, the new floating park on the Hudson River near 13th Street, opens on Friday, and The Green at Lincoln Center is welcoming back live audiences. Also, you can now rollerskate on the tarmac at JFK. If that doesn’t say New York is back, we don’t know what does.

Our take: Begin recalling your pre-pandemic life. Get back out on the town. But stay smart. We haven’t really talked about what will happen if people get too lax too quickly — and we’d prefer not to have to. Stay safe out there!

Further reading:

The Google Store Chelsea, it’s first physical retail store, is coming this summer (The Verge)

Why Restaurants Keep investing in Outdoor Setups Despite the Return of Indoor Dining (Eater NY)

The best things to do during NYC’s reopening week (Time Out NY)

Squarespace is one of those homegrown New York companies with an origin story that can’t be beat. The company was founded in 2004 when Anthony Casalena drove a couple of servers to Manhattan and set up shop in a fourth-floor walkup. Two years later, he was still its only employee.

Fast forward to now: Squarespace yesterday became the latest company to list on the New York Stock Exchange.

It’s a history-marking moment: $SQSP is the first NYC tech company to go public through a direct listing. In opting against an IPO, Casalensa said the direct listing was a better fit “because Squarespace has been a profitable company for a number of years and we don’t need to raise money in this event.” (CNBC) “Pursue the direct listing, give people the option to buy if they want to buy, sell if they want to sell.”

When we hosted Casalena for our Cornell Tech @ Bloomberg speaker series at the end of 2018 (video here), we talked to him about why he chose New York to build his company, and he said the diverse access to talent and aligned industries were unique advantages. At that time, he also prioritized a financial discipline that kept the company at cash flow break-even, a strategy that has set him up for more intentional growth.

Since that chat, the company has expanded its HQ by more than 20 percent and added hundreds of new team members to its ranks. We can’t wait for some of those employees to invest in and even start their own companies right here in NYC.

The takeaway: it was certainly a big day for Squarespace, but it’s also a significant milestone for New York tech. Even in the middle of a pandemic, Casalena has been vocal about his commitment to the NYC ecosystem — it fosters the kind of innovation that leads to broader economic growth, and this listing is just another example of that.

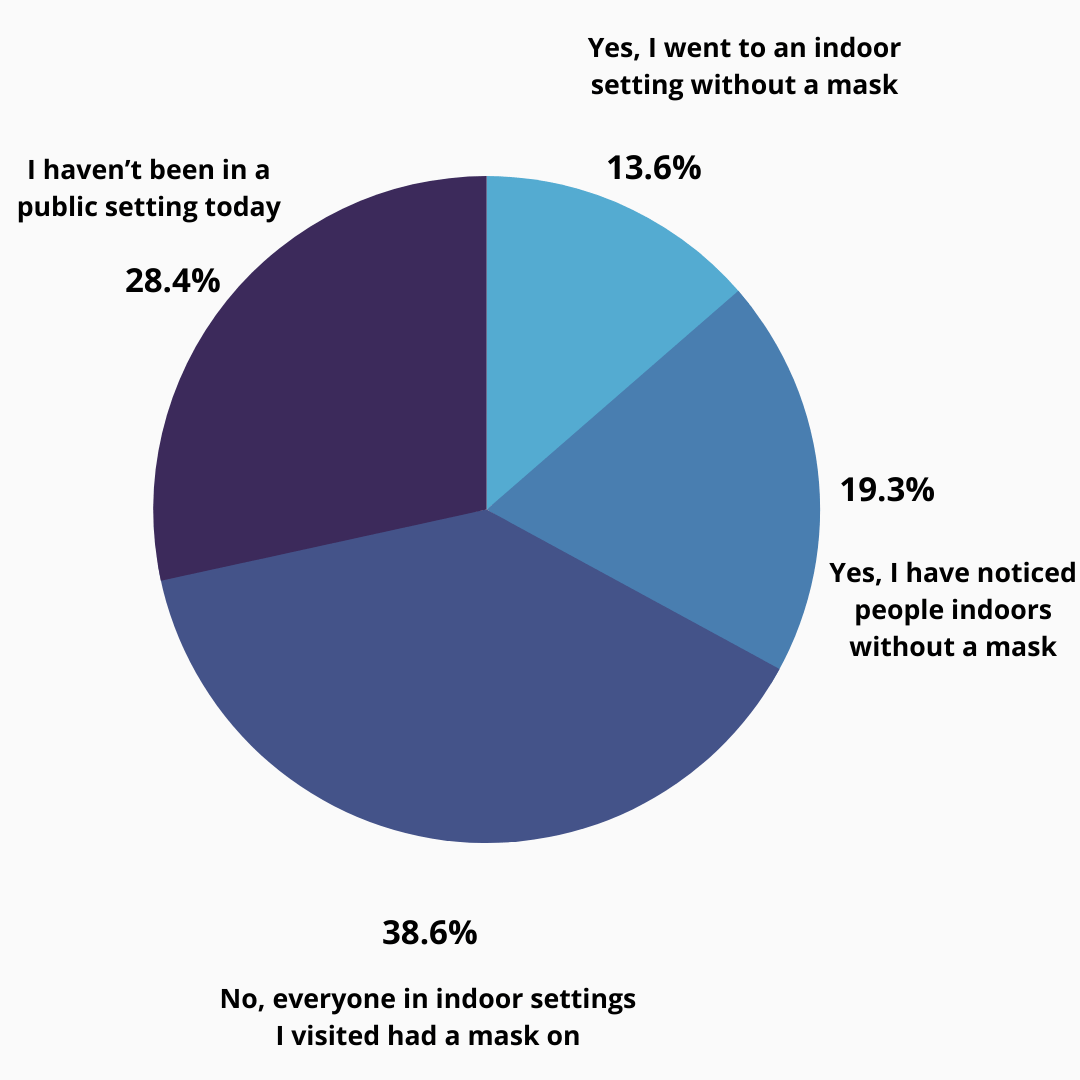

The latest results: The biggest change in reopening is that masks are no longer required in most indoor settings for fully vaccinated individuals. But to avoid the process of verifying who is vaccinated or not, many establishments will continue requiring masks, and many individuals intend to keep wearing them even if they technically don't have to. Have you seen anyone inside that didn’t have a mask on today?

Today's poll

: A day after reopening, the sun is out,

they’ve been in seven months,

, and consumer activity is

. But we’re not out of the woods yet: almost half of New York adults still need their first vaccine dose, many offices still remain empty, and COVID is still spreading in pockets of the country and the globe. How do you feel about New York’s future?

*|SURVEY: I am very optimistic about the future of the city|*

*|SURVEY: I am somewhat optimistic about the future of the city|*

*|SURVEY: I am somewhat pessimistic about the future of the city|*

*|SURVEY: I am very pessimistic about the future of the city|*

Boost Insurance, a New York-based B2B digital insurance platform, raised $20 million in Series B funding. RRE Ventures led, and was joined by Fin VC, Gaingels, Hack VC and insiders Greycroft, Coatue, and Conversion Capital.

Cynerio, a New York-based provider of healthcare IoT cybersecurity, raised $30 million in Series B funding led by ALIVE Israel HealthTech Fund. (CTech)

HiberCell, a New York City-based therapeutics company focused on preventing cancer relapse and metastasis, raised $67.4 million in Series B funding. Investors included Huizenga, Capital Management, Monashee Investment Management, Tekla Capital Management, Hercules Capital, and Mount Sinai Innovation Partners.

Noom, a New York-based weight loss app, received pre-IPO funding from Silver Lake at around a $4 billion valuation. It previously raised over $120 million from firms like RRE Ventures and Sequoia Capital. (Bloomberg)

Piano, a New York City-based provider of analytics and subscription services to publishers, raised $88 million. Updata Partners led the round and was joined by investors including Rittenhouse Ventures and LinkedIn. (TechCrunch)

Polywork, a New York City-based professional social network, raised $3.5 million in seed funding. Caffeinated Capital led the round and was joined by investors including Steve Chen, Kevin Lin, Max Levchin, Joel Flory, Scott Belsky, and Brianne Kimmel. (TechCrunch)

Privacy.com, a New York-based card issuing platform that rebranded as Lithic, raised $43 million in Series B funding. Bessemer Venture Partners led the round and was joined by investors including Index Ventures, Tusk Venture Partners, Rainfall Ventures, Teamworthy Ventures and Walkabout Ventures. (TechCrunch)

Ro, a New York-based DTC pharmacy and primary healthcare platform, acquired Modern Fertility, a San Francisco-based fertility test DTC company that had raised over $20 million from firms like Forerunner Ventures. (New York Times)

Spokn, a New York City-based podcasting platform, raised $4 million in seed funding. Investors included NEA, Y Combinator, Reach Capital, Funders Club, Liquid2, Share Capital, SOMA Capital, Scribble VC and Hack VC.

Tibles, a New York City-based NFT marketplace, raised $1 million in seed funding. Dapper Labs led the round. (Forbes)

Vise, a New York-based investment portfolio management platform, raised $65 million in Series C funding. Ribbit Capital led, and was joined by insiders like Sequoia Capital. (TechCrunch)

Waffle, a New York City-based consumer insurance solution, raised $5 million in seed funding. Verve Ventures led the round and was joined by investors including BetterLabs Ventures and Techstars.

May 21: May 21: Virtual: Forging NYC’s Path Towards Accessible Childcare, with NYCEDC president and CEO Rachel Loeb, Maven founder and CEO Kate Ryder, and an expert panel moderated by New York Times reporter Alisha Haridasani Gupta. Hosted by women.nyc and Maven. Register here.

May 26: Virtual: A briefing on Ranked Choice Voting in the NYC primary election, with Rank the Vote NYC and Gotham Gazette executive editor Ben Max. Hosted by Tech:NYC. Register here.

June 1: Virtual: A Tough Love Letter to the Machines That Rules our Jobs, Lives, and Future, with Cognizant’s Center for the Future of Work co-founder Ben Pring. Hosted by Betaworks Studios. Register here.

Around the same time the pandemic was peaking in New York, the NYC Commission on Human Rights began mapping an influx of incidents of anti-Asian violence in the city — you can dig a little deeper on its findings here. And today, Pres. Biden signed into law an anti-Asian hate crimes bill that will expedite the review of hate crimes and make it easier to report them. For the remainder of AAPI Heritage Month, there’s plenty of ways you can get involved too.

Any feedback or suggestions of things to add? Get in touch here. Was this digest forwarded to you? Sign up to receive it directly here.